Prev Post

Purandar Airport Land Acquisition Cut to 3000 AcresNew Mahabaleshwar: A Rare Land Opportunity in a Growing Hill Station

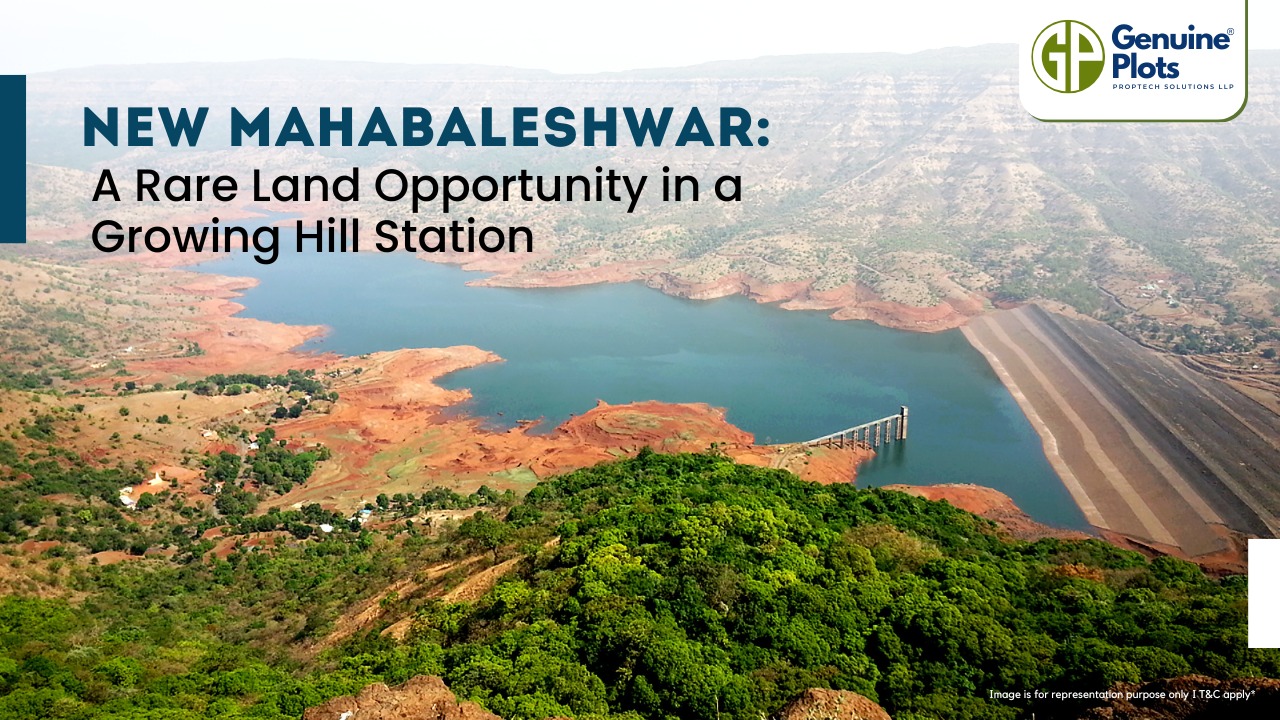

The New Mahabaleshwar Hill Station Project is one of Maharashtra’s most exciting initiatives to develop tourism and boost the local economy. Spread across 235 villages in Satara, Jaoli, Patan, and Mahabaleshwar, this area lies in the ecologically rich Western Ghats, a UNESCO World Heritage site. The region is famous for its green forests, waterfalls, hills, and valleys, making it a top choice for leisure, adventure, and religious tourism.

The Maharashtra government is taking major steps to develop New Mahabaleshwar, including building roads, electricity, water supply, and public amenities. Plans also include housing, commercial areas, gardens, recreational zones, and institutional facilities, ensuring a well-planned, sustainable growth of the region. With the government promoting tourism through public-private partnerships, this area is set to see rapid development and high-value appreciation in the coming years.

Why Investing Here Makes Sense

- High Future Appreciation: Over time, land and property values will rise due to government-supported infrastructure and tourism initiatives.

- The Prime Location: It is appealing for vacation homes and resorts because it is close to major highways and has good access to urban centres.

- Eco-Friendly Development: Long-term value is added by balanced development, which guarantees the preservation of biodiversity and natural beauty.

- Various Investment Options: Land can be turned into vacation residences, resorts, or resale plots.

Investing in plots in this area today can be a rare opportunity for buyers to secure land in a promising and growing hill station before the region reaches its full potential.

Seize the opportunity now — New Mahabaleshwar is set to become one of Maharashtra’s most sought-after destinations for tourism and investment.

PMC’s Bharat Mandapam Plan in Lohgaon Raises Transparency Concern

A proposed development of a “Bharat Mandapam” has been announced by the Pune Municipal Corporation (PMC), involving the allocation of a substantial 27 acres of land that was meant for public amenities in Lohgaon. This has stirred a debate among locals and activists regarding a possible lack of transparency.

Under the existing Development Plan, land use in Lohgaon was allocated for public utilities such as roads, gardens, hospitals, parking, and open spaces. The PMC proposal would shift this land use for the new “Bharat Mandapam” project, raising questions about what would happen for future needs.

The civic body has called for public suggestions for the plan, which has to reach them by December 28. However, many citizen forums and organisations feel that not many details are being shared for this purpose. Activists are now demanding that PMC share complete project documents in the public domain before citizens can finalise their objections and suggestions for the same.

Moreover, some critics have attributed any possible failure of infrastructure development to the cancellation of civic amenity sites. This may particularly happen in a region where development is taking place at a rapid rate.

As the debate goes on, the citizens, as well as activist groups, continue to call for an extension of the period of consultation.

Maharashtra to Appoint Licensed Private Surveyors to Complete Land Measurement Work within 30 Days

The government of the Indian state, Maharashtra, has declared that it will employ authorised private land surveyors to complete land measurements within 30 days, which is considerably shorter than the earlier period of 90 to 120 days. Notably, it can be said that this move will bring about a landmark change in land administration. Notably, this move in land administration will help significantly lessen pending land measurement cases.

Clearing the Backlog with Speed and Technology

Revenue Minister Chandrashekhar Bawankule described the move as “a revolutionary step in the history of the department. Chief Minister Devendra Fadnavis has supported the initiative as part of broader reforms to strengthen land governance through technology and citizen-centric systems.

Government verification ensures that the data is correct.

The actual fieldwork will be done by private surveyors, whose measurements will be verified and signed by senior government functionaries at the level of Taluka Land Records Inspectors, Deputy Superintendents of Land Records, or City Survey Officers. This two-tier verification is a fast track that ensures correct and legally valid land measurement results.

The deployment of about 150 private surveyors in each district was a plan to support the rollout of this by the government, extending the survey capacity and solving the shortage of government survey staff that slows operations.

Broader Vision: More Transparent Land Records

The policy is also expected to support a long-term shift in how land transactions are handled. Officials are exploring a “measure first, register later” approach—where land is surveyed before a sale deed is executed and mutation entries are made. This will help prevent disputes caused by discrepancies between the sale deed descriptions and actual on-ground boundaries.

Effects on Investors and Citizens

Landowners, farmers, developers, and constructors are among those who will greatly benefit from the reform. Fast measurement services will

- Speed up real estate transactions

- Decrease border-related legal disputes

- Enhance trust in land records.

Conclusion

The state of Maharashtra is also proceeding with the modernisation of its land administration system by incorporating private certified surveyors for land measurement, with a defined 30-day timeframe to complete the task. The move not only seeks to clear past arrears but will also enhance convenience in matters concerning land.

In order to support Pune's expanding logistics ecosystem, Welspun ONE has announced plans to build a massive logistics park in Talegaon, Pune, with a total investment of ₹550 crore.

Location of the Project: Talegaon, Pune

Talegaon, a major industrial and logistics hub close to Pune, is perfect for contemporary warehousing infrastructure because it has excellent highway connectivity and is close to manufacturing clusters.

Investment & Development Scope

The ₹550 crore investment will go into building a state-of-the-art logistics park with advanced warehousing, efficient logistics infrastructure, and scalable facilities for large occupiers.

Purpose of the Logistics Park

The project aims to meet rising demand from e-commerce, manufacturing, and third-party logistics companies seeking efficient supply chain solutions in Western India.

Economic & Regional Impact

The development is expected to:

Boost regional employment

Support industrial growth

Enhance Pune’s position as a logistics and distribution hub

Impact on Land & Real Estate

Large logistics investments typically increase demand for industrial land and warehouse-ready plots in nearby areas, potentially driving long-term land value appreciation around Talegaon.

Maharashtra Cabinet Abolishes Colonial-Era Non-Agricultural Tax, But Uncertainty Persists

The Maharashtra government’s recent decision to abolish the Non-Agricultural (NA) tax has been welcomed across urban housing societies. However, despite the cabinet approval, the lack of formal implementation has led to widespread confusion among residents and managing committees.

What Is the Non-Agricultural (NA) Tax?

NA tax is a colonial-era levy imposed on land converted from agricultural to non-agricultural use.

It applies to residential and commercial properties built on such land.

Housing societies pay this tax in addition to the regular property tax, which can lead to double taxation.

Cabinet Decision to Abolish NA Tax

The elimination of the NA tax on urban residential properties has been approved by the Maharashtra Cabinet.

The goal of the action is to lessen housing societies' financial burden.

The ruling is viewed as a step in the direction of doing away with unnecessary and antiquated taxes.

Lack of Government Resolution Causes Confusion

No formal Government Resolution (GR) has been issued, despite cabinet approval.

Without a GR, local revenue departments lack clear instructions.

Housing societies are uncertain about whether the tax has been abolished in practice

Housing Societies Still Receiving Tax Notices

Several housing societies, especially in cities like Mumbai and Pune, continue to receive NA tax demands.

Some societies are paying the tax to avoid penalties and legal complications.

Others have chosen to withhold payment, awaiting official clarification.

Impact on Residents and Managing Committees

Managing committees are caught between compliance and the anticipation of exemption.

Fear of fines, interest, or legal action adds to the anxiety.

Residents remain unsure about future refunds or adjustments.

Maharashtra Tables Bill to Remove Non-Farm Use Certificate Requirement for Conversion of Agricultural Land

The Maharashtra government has made a substantial step toward streamlining land-use procedures. During the winter session, Revenue Minister Chandrashekhar Bawankule presented the long-standing requirement of a non-farm use certificate called Sanad to the Legislative Assembly.

What Is Being Changed?

Until now, landowners in the state seeking to convert agricultural land into non-agricultural use had to navigate a multi-layered approval process. Even after securing the necessary non-agricultural (NA) permission, they still needed to obtain a Sanad — a legal certificate issued by revenue authorities — before legally developing or selling the land. This added layer often resulted in delays, higher costs, and bureaucratic hassles for ordinary landowners.

Under the Maharashtra Land Revenue Code (Second Amendment) Bill, 2025, the requirement to obtain this Sanad will be completely eliminated. Instead, landowners will be required to pay a one-time nominal premium based on the Ready Reckoner rate to regularise the change in land use. The new structure is as follows:

- Up to 1,000 sq. metres: 0.1% of the Ready Reckoner value

- 1,001 to 4,000 sq. metres: 0.25% of the Ready Reckoner value

- Above 4,001 sq. metres: 0.5% of Ready Reckoner value

This premium replaces the need for the Sanad, making the process simpler and more predictable for landowners.

Why This Matters

For decades, the Sanad certificate was seen as a bureaucratic bottleneck that slowed down land conversion and deterred investment and development. Even after earlier reforms between 2014 and 2018 relaxed the NA permission requirement, the Sanad remained a hurdle. The new amendment aims to eliminate that final administrative barrier.

Benefits for Citizens and Landowners

The reform is expected to have several practical benefits:

- Faster Approvals: Land use change will be processed more quickly without the need for a separate Sanad certificate.

- Reduced Costs: With a predictable premium based on Ready Reckoner rates, landowners can better plan their finances without multiple fees.

- Encourages Development: Simplified rules are likely to encourage more residential and commercial development, particularly in peri-urban and rural areas.

- Ease of Doing Business: By cutting red tape, Maharashtra is aligning its land administration with broader national goals of improving the business environment.

Government Assurances

The state government has clarified that the removal of the Sanad requirement will not impact the revenue of local self-governing bodies — such as municipal corporations and panchayats — which will continue to receive their share of taxes and fees as before.

What Happens Next?

The bill has been tabled in the Assembly and must be passed by both houses of the state legislature and receive the Governor’s assent before becoming law. If enacted, it would mark one of the most significant simplifications of land conversion procedures in the state in recent years.